Advantages of Preparing Cash Budget

This article discusses how long it might take for you to cash out your 401 k once youve left your job. Provides precise timing of when cash comes in and out of the company.

Advantages And Disadvantages Of Budget What Is Budget Advantages And Limitations Of Budget A Plus Topper

Read more for all the quarters.

. Lets look at an example using Blue Company. The master budgetwhich culminates in a cash budget a budgeted income statement and a budgeted balance sheet formally lays out the financial aspects of managements plans for the future and assists in monitoring actual expenditures relative to those plans. Here are some key pros and cons.

Budgets are used for two distinct purposes planning and control. If there are many categories of direct labor then preparing a budget takes too much time and becomes a complex process. The cash budget template is for educational purposes only and should not be relied upon without professional advice.

Blue Company has a budget of 10 million in revenue and 4 million in costs of goods sold. Here are the basic steps to follow when preparing a budget. Generally we dont take cash requirements to calculate such a budget.

With our easy-to-use accounting software for accountants bookkeepers and SMEs as well as your free trial you can be sure that youll never accidentally overspend on your marketing. Pros and Cons of a Cash Budget. Free cash flow is the net change in cash generated by the operations of a business during a reporting period minus cash outlays for working capital capital expenditures and dividends during the same period.

These outflows will include all the cash payments made for purchases of raw materials inputs or semi-finished products consumables any cash to be paid for the purchase of a fixed asset during the period provisions for repairs and maintenance labor. It would help if. If you want help to streamline your marketing budget so that you can earn all of the benefits of marketing without the financial headaches contact the team at Big Red Cloud today.

There are several advantages and disadvantages in preparing a budget on a cash basis. Instead the cash requirements are part of the master budget. One issue with the calculation is regarding cash requirements.

Preparing the budget will take into consideration all the probable cash outflows during the budget period. It works the other way too if you end up needing to produce 1400 units you can use the flexible budget to scale up your total cost. Prepare the sales budget of the company for the year ending in 2020.

Planning involves developing goals and preparing. Also the sales discount and allowance percentage will be 2 of gross sales Gross Sales Gross Sales also called Top-Line Sales of a Company refers to the total sales amount earned over a given period excluding returns allowances rebates any other discount. Review the assumptions about the companys business environment that were used as the basis for the last budget and.

If you dont want to cash out the old account you can generally transfer the money to a new 401 k plan or IRA account. The process of preparing a budget should be highly regimented and follow a set schedule so that the completed budget is ready for use by the beginning of the next fiscal year. This is a strong indicator of the ability of an entity to remain in business since these cash flows are needed to support operations and pay for ongoing capital.

Of that 4 million budget only 1 million is fixed. It also goes over your possibilities for doing so and the different types of 401 k account you can have.

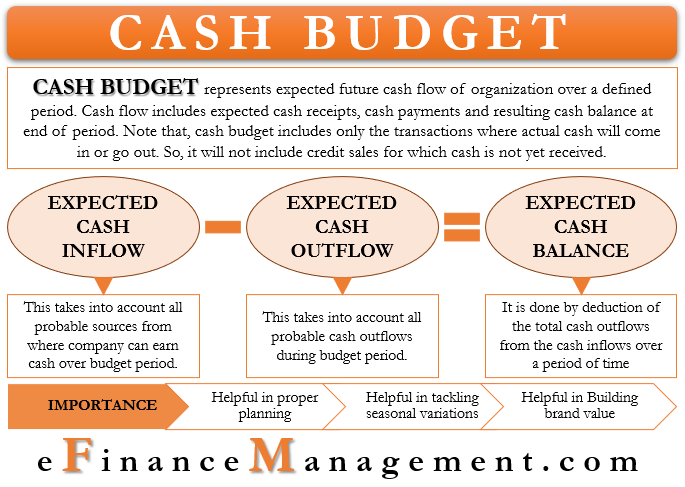

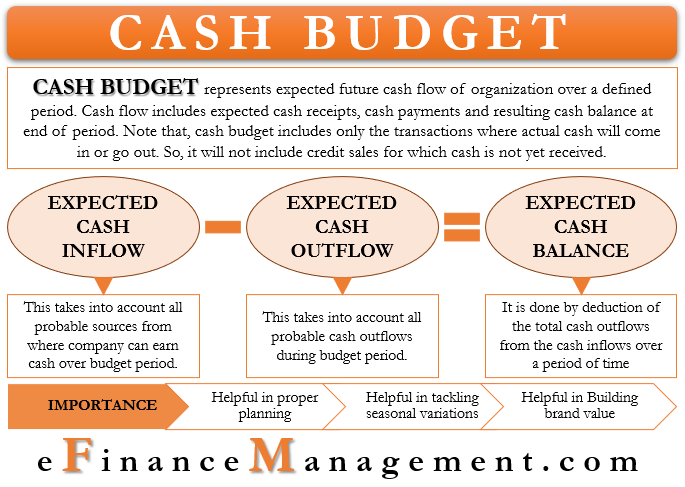

Cash Budget Meaning Preparation Example Importance

Budget And Budgetary Control Notes Management Accounting Notes

15 Cash Budget Advantages And Disadvantages Brandongaille Com

Advantages And Disadvantages Of Budget What Is Budget Advantages And Limitations Of Budget A Plus Topper

Comments

Post a Comment